The mortgage industry has undergone a whirlwind of change over the last few years. When the COVID-19 pandemic first arrived, housing market activity plunged to lows not seen in a decade before rapidly recovering and reaching all-time highs just a few months later. Today, activity has once again receded due to a confluence of factors, including rising inflation, high interest rates, and a dearth of housing supply.

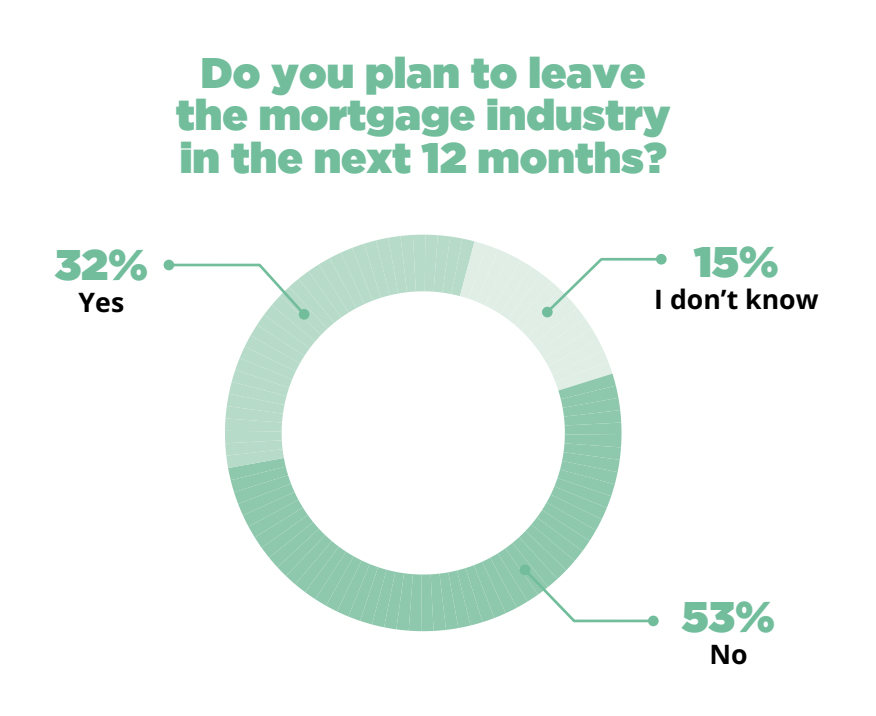

Add it all up, and mortgage professionals have seen it all over the last several years. Facing an uncertain market, 31.5% of survey respondents indicated they’re thinking about leaving the industry within the next 12 months while 15.6% are unsure. Altogether, 56% of mortgage professionals agree that market uncertainty will impact their decision to stay or leave the industry in the coming year.

To continue serving customers effectively while maintaining profitability in what’s already a low-margin business, mortgage companies need to do everything within their power to keep loan officers and other mortgage professionals happy and engaged. Believe it or not, industry experts say that replacing an employee can cost as much as twice their salary. Couple that with the fact that it can take new hires a year or even longer to become fully productive, and it’s easy to see why mortgage leaders need to prioritize retention and engagement.

Everee surveyed 314 U.S.-based professionals in the mortgage industry who have commission-based roles. Of this group, 35% are managers, 27% are loan officers and originators, 18% are loan processors, 8% are underwriters, and the rest have other roles. Further, 52% of respondents have worked in the industry for at least five years.

Our research revealed simple steps can go a long way toward convincing employees to stick around. Survey respondents agreed that they were most likely to continue working for companies that pay commissions faster and offer flexible working hours and the ability to work remotely.

In this report, we’ll examine three key ways mortgage companies can increase engagement and retention and thrive in a challenging real estate market without having to reinvent the wheel.

Financial challenges

With 60% living paycheck to paycheck, mortgage professionals are struggling financially

In an era of rising inflation and high interest rates, it’s a challenging time for mortgage professionals. There are fewer deals happening, which means the time between commissions payments are stretching longer and longer. It comes as no surprise then that when we asked mortgage professionals what matters most to them when choosing an employer, they ranked commission rates as the #1 factor.

While you may already know that 68% of U.S. workers live paycheck to paycheck, you might be surprised to learn that 60% of mortgage professionals live paycheck to paycheck, too, according to our research.

Living paycheck-to-paycheck causes financial stress that can impact productivity but speeding up how quickly they receive payments can help. Respondents to our survey echoed this sentiment, with 84.4% agreeing that getting paid faster would enable them to manage their finances more effectively, alleviating some financial stress.

By paying mortgage professionals more competitively and ensuring they get the money they’ve earned sooner, brokers can differentiate themselves from their competitors and attract and retain top talent.

Pay preferences

Mortgage professionals want to be paid faster and majority say speed of pay influences where they work

An easy way to increase retention and improve employee happiness is by paying out commissions faster. In fact, mortgage professionals consider the speed of pay to be more important than things like company culture, health benefits, and retirement benefits when deciding where to work.

Yet across the industry, slow pay is still common: In today’s real-time, on-demand era, just 6.7% of mortgage professionals get commissions within one day; more than 60% have to wait at least two weeks to get paid. More specifically, 32.8% of mortgage officers get commissions within a week, 26.8% get them within two weeks, 22.3% get them within a month, and 11.5% get them even later.

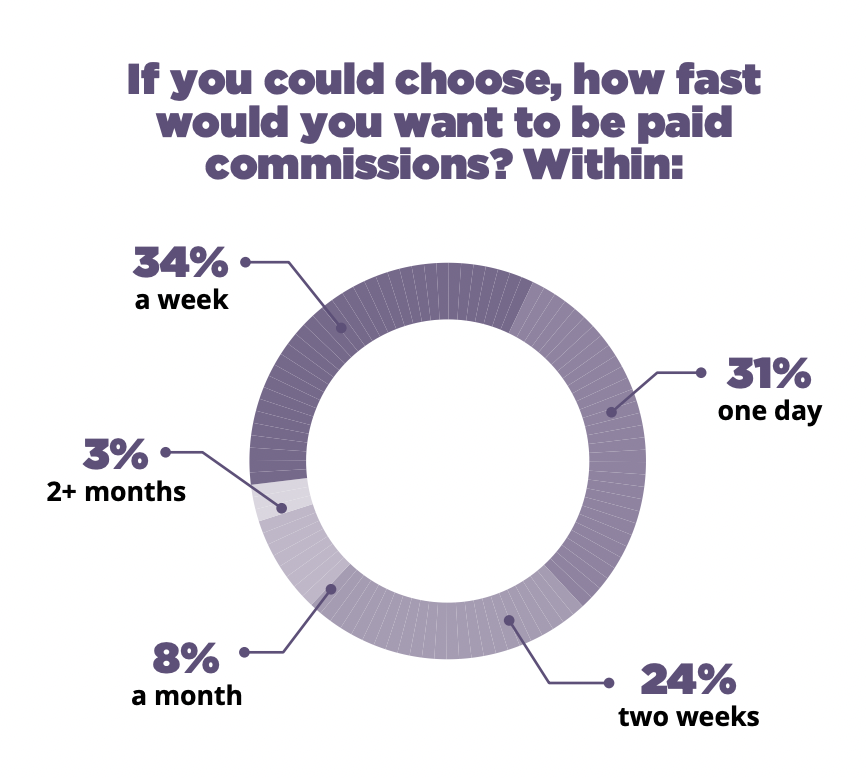

When given the choice of how fast they’d receive their commissions after a loan closes, 31% of mortgage professionals said one day, 34% said within one week, and 24% said within two weeks. Phrased another way, 65% want to get paid in a week or less but only 40% actually get paid that fast. Add it all up, and it comes as no surprise that 38.5% of loan officers are unhappy with how quickly they’re paid — and this mismatch could result in increased turnover.

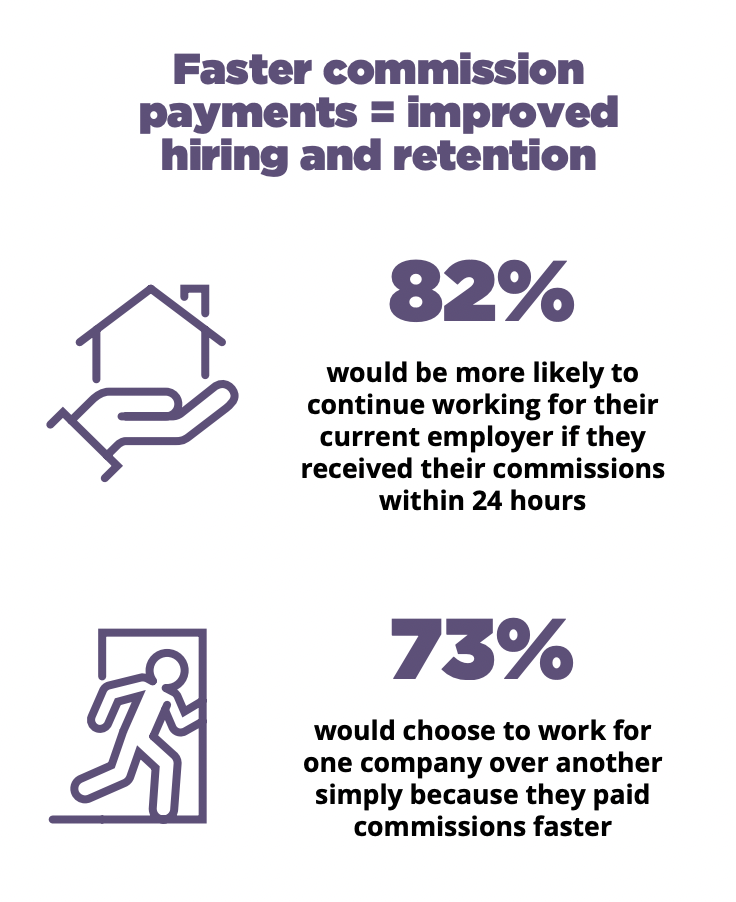

What’s more, our research also found that 82.2% of loan officers would be more likely to continue working for their current employer if they received their commissions within 24 hours. All else being equal, 72.6% of mortgage professionals would choose to work for one company over another simply because they paid commissions faster.

By offering commission-based employees the ability to receive commissions within 24 hours of a loan closing, mortgage companies can increase retention, protect margins, and attract new talent — all without any heavy lifting.

Workplace flexibility

Remote work and flexible hours rank high in what mortgage professionals want

When the pandemic first hit, businesses across all sectors of the economy, including mortgage firms, were forced to rapidly pivot to remote work. For the most part, these transitions went smoother than most expected, much to the delight of both executives and employees.

As we continue to move beyond the pandemic, however, more and more businesses are encouraging employees to return to the office; as an industry built on person-to-person relationships, mortgage firms have largely reined in their remote workforces, as teams are once again working out of the office.

Unfortunately, mortgage companies that commit to returning to the office may find themselves having to address rising turnover. According to a recent report by McKinsey, 87% of employees choose to work remotely when given the chance. This data mirrors the findings of our research: Aside from getting paid more, mortgage professionals were most interested in working for companies that offered flexible working hours and flexible working locations.

Since 58% of workers would “absolutely” look for a new gig if they weren’t able to work remotely anymore — and 31% are unsure — mortgage companies should strongly consider meeting employee expectations by offering some version of flexible work. While it might not make sense to allow employees to work from home five days a week, perhaps one or two days could do the trick.

Speed up mortgage commission payments with Everee

If you’re looking to increase employee retention and build a more resilient mortgage business, Everee can help. Our payment solutions enable mortgage companies to pay out commissions the same day a loan closes, which meets employee expectations and helps your brokerage stand out from other companies while increasing the chances your team sticks around.

Perhaps most importantly, Everee enables workers to exert more control over their personal finances, making it easier to manage their obligations and reduce financial stress.Employees can onboard quickly, adjust their tax rates, and see their pay stubs — all within a simple app.

Mortgage firms can get up and running fast with Everee’s high-touch implementation and save money by only being charged if someone is paid in any given month — all without stressing about compliance, which our team handles end to end across all 50 states.

To learn more about how your mortgage company can use Everee’s payroll software to increase retention, engagement, and profitability, request a demo today.