AB5, otherwise known as the gig worker law, is a California state law that significantly restricts the ability of an employer to classify workers as contractors instead of employees. If you’re based in California and and you regularly hire or lease truckers working as independent contractors, AB5 significantly impacts your operations.

Need an overview of California’s gig worker law? Read my post: What is AB5?

Is AB5 in effect for truck drivers?

Yes, motor carriers in California are subject to AB5. On June 30th, 2022, the United States Supreme Court announced that they would decline to hear a case brought by the California Trucking Association (CTA) challenging the legislation, thrusting the trucking industry back into compliance with the law.

With AB5 now applying to truckers in California, we’ll review the obligation of motor carriers to correctly classify their independent truckers as employees, the timeline of events as it relates to legal challenges to the law and the current status of truckers working in California.

How does AB5 affect trucking companies?

AB5 was originally intended to make ride hailing and delivery companies (Uber, DoorDash, Lyft, etc.) classify drivers as employees, thus entitling them to certain pay and work benefits. However, the actual scope of the language in AB5 reaches far broader and changes the classification of workers in most California-based trucking and logistics companies.

Under AB5, most California workers are considered employees unless the profession is part of the AB5 exemptions or the employer can meet the standards established by the law’s ABC test.

Does AB5 ban owner-operators?

No, AB does not ban owner-operators in California. However, the law does make it very difficult for trucking companies to use them. Under AB5 and the ABC Test, a motor carrier must prove that their workers are not employees by demonstrating that the worker is:

- Free to perform services without the control or direction of the company.

- Performing work tasks that are outside the usual course of the company’s business activities.

- Customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

Given that most owner-operators are contracting directly with shipping, transportation, or logistics companies, the second prong of the ABC Test will likely be impossible to prove.

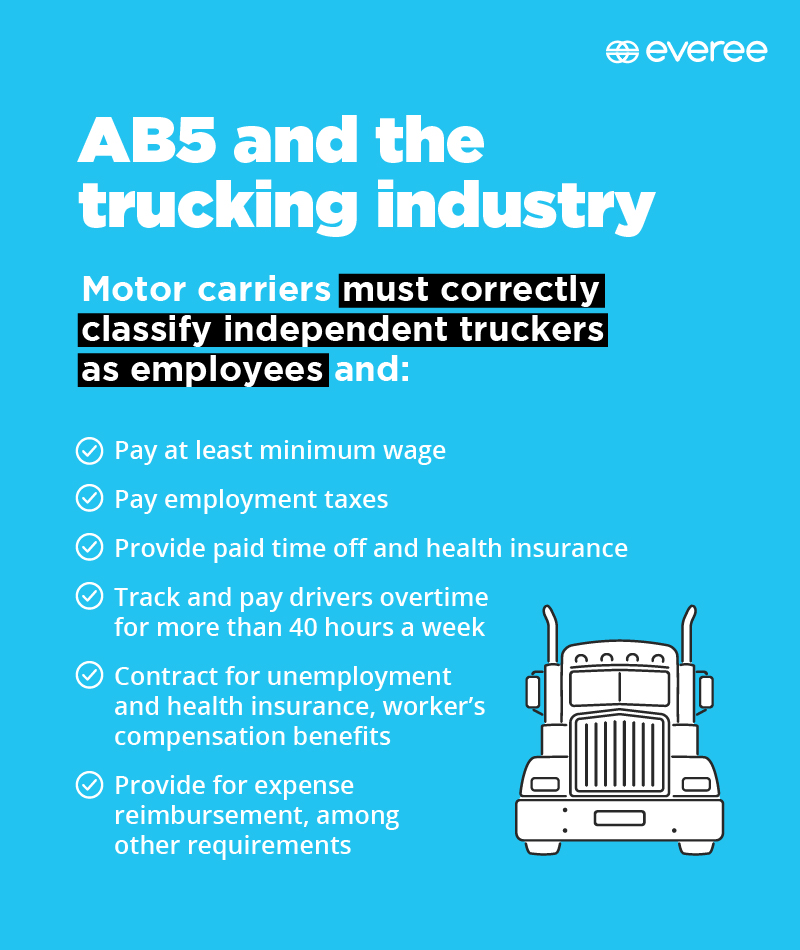

Obligations to truckers working as employees

Reclassifying independent contractors as employees at your trucking company means you now have to:

- Pay at least minimum wage

- Pay employment taxes

- Provide paid time off and health insurance

- Track and pay drivers overtime for more than 40 hours a week

- Contract for unemployment and health insurance, worker’s compensation benefits

- Provide for expense reimbursement, among other requirements.

Other less direct expenses such as payroll overhead, employee oversight and compliance, vacation scheduling, etc. will also be incurred. All of these things have the potential to create a significant cost increase for many small companies. Finally, under AB5, misclassification of an employee as a contractor could mean a fine of up to $25,000 per employee so the penalties for violations can be quite steep.

RELATED READING: Scaling a logistics and transportation company with fast pay [Case study]

Are truckers exempt from AB5?

Assembly Bill 2257 greatly expanded and clarified the exceptions to AB5. Under AB2257, additional exemptions were added for some business-to-business contracting relationships, referral agencies, entertainers, musicians, photographers and others.

While a larger number of professions are now exempt from the reach of AB5, none of the exemptions added under AB2257 provided relief to the trucking industry.

Unlike a bevy of professions, the trucking industry was unable to secure an exemption to the AB5 law that took effect January 1, 2020. At that time, more than 60% of the owners-operators driving in California—who were formerly classified as independent contractors—were suddenly defined as employees of the trucking companies they worked for.

California Trucking Association lawsuit

Despite not having an exemption, the trucking industry did not have to comply with AB5 shortly after the law took effect based in large part on the efforts of the California Trucking Association (“CTA”).

In November of 2019 (CTA v Bonta) the CTA initially filed a lawsuit in federal court to stop the implementation of AB5. The District Court issued an injunction and restraining order a few months later, thereby halting the implementation and enforcement of AB5 for the trucking industry. However, the Court of Appeals overturned the District Court, paving the way for AB5 to move forward.

More recently, the CTA appealed the ruling of the Court of Appeals and filed an appeal with the US Supreme Court to hear the case. Given the lack of finality in the case, the Court of Appeals agreed that the injunction against implementation of AB5 could remain in place until the US Supreme Court made its decision.

On June 30, 2022, the US Supreme Court announced they would decline to hear arguments in the CTA v Bonta case. This meant that the previous ruling of the Court of Appeals would stand and AB5 is now in effect for the trucking industry.

What should trucking companies do now?

Because AB5 as it applied to truckers was tied up in legal challenges for so long, the trucking industry at large is still scrambling to make the necessary changes. Many motor carriers were not prepared for AB5 to take effect at the end of June and are still working on how to comply. In a show of resistance, truckers haven taken to protesting ports in Oakland, Los Angeles and Long Beach—even going so far as to close the Port of Oakland. These demonstrations show the frustration among truckers about being forced to work as employees—and add even more strain to the supply chain.

Now that AB5 is in effect for truckers, trucking companies that contract with owner-operators in California must treat them as employees. This means these truckers are now entitled to the same rights and protections as any other employee in California. Trucking companies are subject to providing their truckers minimum wage payment, workers’ compensation, unemployment insurance, and paid sick days. Trucking companies must also provide expense reimbursement for things like fuel and maintenance.

Industry groups like the CTA and the Owner-Operator Independent Drivers Association are vowing to challenge the law in other ways, including a claim that AB5 violates the Commerce Clause of the U.S. Constitution.

For now, trucking companies need to do what they can to get out of employee classification limbo and work with their legal teams to ensure they are in compliance with AB5. They should also reach out to their insurance providers to make sure their policies are still valid and adequate. Finally, they need to start having conversations with their owner-operators to discuss the changes AB5 will have on their business relationship and make the necessary payroll and benefit changes needed to supply truckers with employee protections.

Timeline of events for AB5 and the trucking industry

This section provides a reference to the various dates and activities associated with the CTA litigation against AB5.

18 Sep ‘19: Governor Newsom signs the legislation to enact AB5.

14 Nov ‘19: The California Trucking Association (“CTA”) filed suit, claiming AB5 was a violation of federal law in the CTA v Bonta case (“Bonta” is the California Attorney General, representing the State of California in litigation).

31 Dec ‘19: Federal District Court issues a preliminary injunction in CTA v Bonta, temporarily halting the implementation of AB5 as it effects the trucking industry.

1 Jan ‘20: AB5 takes effect.

13 Jan 20: Federal District Court upgrades the preliminary injunction in CTA v. Bonta to a temporary restraining order.

4 Sep ‘20: The California legislature passed AB 2257, which exempts a long list of job categories from the standards of AB5, but truckers are still subject to AB5.

3 Nov ’20: California voters approved Proposition 22 (an initiative backed by Uber, Lyft, and DoorDash) effectively overriding AB5 for certain app-based ride-hailing and delivery services by classifying them as independent contractors, but does not address the trucking industry.

28 Apr ‘21: 9th Circuit overturns the Federal District Court in CTA v Bonta, removing the preliminary injunction.

26 May ‘21: CTA petitions for a rehearing of the decision by the 9th Circuit in CTA v. Bonta.

21 Jun ‘21: 9th Circuit denies the CTA petition for a rehearing of the CTA v. Bonta case.

21 Jun ‘21: CTA petitions the 9th Circuit to maintain the preliminary injunction against AB5 while it appeals to the Supreme Court of the United States to review the decision of the 9th Circuit in CTA v. Bonta.

23 Jun ‘21: 9th Circuit grants CTA’s petition to maintain a preliminary injunction AB5 that prevents the implementation of AB5.

9 Aug ‘21: CTA petitions the U.S. Supreme Court to review CTA v Bonta.

15 Nov ‘21: The Supreme Court invites the Solicitor General to file a brief on CTA v. Bonta to present the position of the United States Government.

24 May ‘22: The Solicitor General files a brief to present the position of the United States Government in CTA v Bonta.

30 June ‘22: The Supreme Court announced they would not hear the CTA’s petition for a hearing.

Additional information about the CTA and the CTA lawsuit can be found at the CTA AB5 FAQ page.

Other resources for AB5 compliance

- An overview of AB5

- The ABC test explained

- List of A5B exemptions

- Prop 22 and AB5 exemptions for drivers

Disclaimer – Yes, I’m a lawyer, but I’m not your lawyer. All information in this post is provided for educational purposes only and should not be considered legal advice for any specific person or specific situation.

About the author

Mark F. Wright, JD

Mark has extensive experience in the practice of law, business management, and engineering in a wide variety of corporate, government, and private sector environments. Mark has successfully assisted various small companies as well as Fortune 500 companies in developing their patent, trademark, and technology licensing portfolios, specializing in emerging computer hardware and software technologies.