If you run a business, you know that payroll is one of your most critical business operations. And, if you’re like most businesses, you probably process payroll on a bi-weekly basis. But what if there was a way to pay workers everyday? Believe it or not, it’s possible (and becoming a lot more popular) with the help of modern payroll technology.

The term “daily payroll” is certainly new if you have experience working in finance or HR. With growing worker demand and evolving payroll solutions, daily payroll is set to become the new normal.

Today, businesses are grappling to find competitive advantages in one of the tightest labor market’s in recent memory, and a daily pay benefit could be the answer. While the standard payroll cycle can work for some workers, data shows that 68% of workers today are living paycheck to paycheck. For many, getting paid every day would be deeply beneficial to their financial health and not just a perk. Offering daily pay to workers is attractive to potential candidates and a driver of retention for existing staff.

The business advantages are clearly there and running daily payroll isn’t as hard it sounds. We’ll dive into the details below.

What is daily payroll?

Daily payroll is a way for businesses to process payroll and pay their workers every day for their work. With traditional bi-weekly payroll, workers are paid every other Friday (or whatever day of the week your business designates). With daily payroll, workers get their wages every day.

RELATED READING: Real time payments for workers explained

How daily payroll works

So, how does one go about processing payroll on a daily basis?

The technology that makes daily payroll possible is called Automated Clearing House (ACH). ACH is an electronic network that processes financial transactions in the U.S. Most banks in the country participate in ACH, which means they can send and receive money electronically. This network is what allows businesses to make direct deposits into employee bank accounts. When someone gets paid via ACH, their employer sends a transfer of the worker’s net pay to the worker’s specified bank. The ACH network then routes the funds to the employee’s account, and they receive their money.

In 2015, the ACH Rules were changed to allow for the for same-day processing and settlement of virtually any ACH payment. This means that businesses can make direct deposits into employee bank accounts on the same day they’re initiated. Since then, the Same Day ACH regulations have been updated with regard to availability and transfer limits. On March 18, 2022, the latest set of ACH rules was changed to raise the same-day ACH dollar limit to $1 million per transaction.

Employers can look for modern payroll solutions that are built on same-day ACH technology, which would allow for the same-day deposit of wages for workers. While same-day pay is common today for 1099 contractors, solutions for W-2 workers are harder to find, due to complications with tax withholdings and wage calculations. (Everee, however, supports same-day pay for both worker types.) Since September 2016, more than 1.5 billion same-day ACH transactions have been processed.

How often should you process payroll?

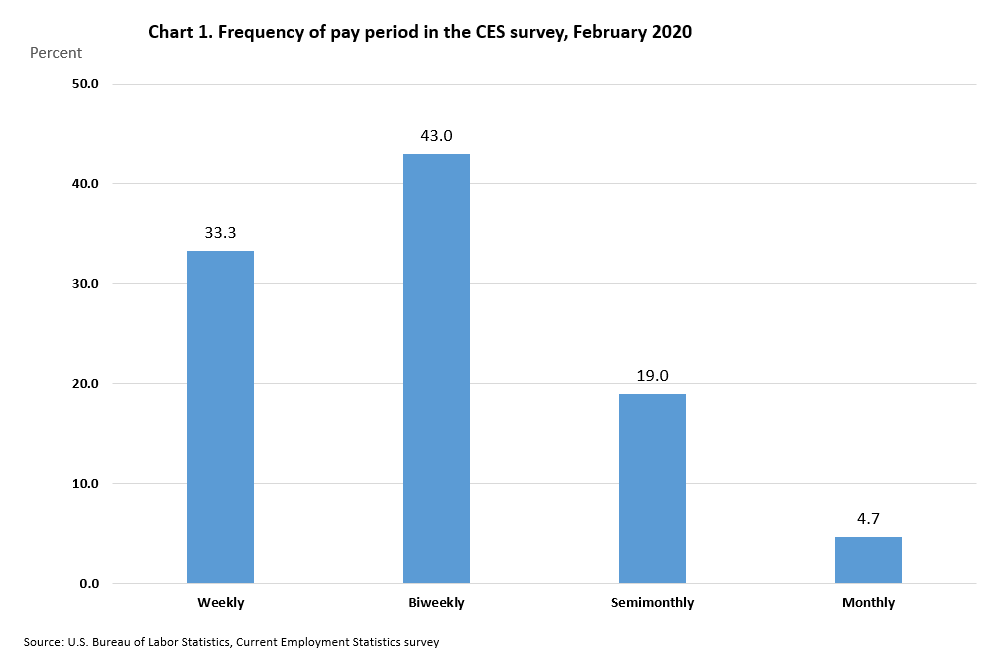

The largest number of U.S. businesses process payroll on a bi-weekly basis, as well as weekly, semi-monthly or monthly. Of course, accurate and timely payroll processing is vital as it shows that you value your workers’ contributions. Determining a pay period that you can consistently and successfully execute is key. Common pay periods are:

- Daily

- Weekly

- Bi-weekly

- Semi-monthly or

- Monthly

Historically, the bi-weekly pay cycle developed in the mid 20th century as accountants and business leaders manually processed deductions and taxes. While bi-weekly payroll is business standard, it’s not ideal for workers. Financial emergencies hurt worker productivity, and a growing number of companies—especially in the gig economy—are offering faster pay periods.

Is it better to get paid daily or weekly?

Studies show that 83% of U.S workers between the ages of 18-44 believe they should earn their wages at the end of each shift or workday. Independent contractors, in particular, want speedy payments, with 40% stating that they want to be paid daily and 84% wanting to pay within 7 days.

Demand for faster pay is likely to grow as the world adjusts to the post-pandemic economic reality. Trends like rising inflation makes it more difficult for people to financially survive within the standard two-week pay cycle as it stretches their earnings for too long to cover the cost of living.

Daily vs. weekly pay comes down to what’s best for your workers and your business. Current technology clearly supports daily payroll runs, but weekly may be more desired among your workforce. Consider surveying your staff to see what they prefer.

Benefits of a daily paycheck

While it’s tempting to keep the status quo of bi-weekly (or longer) payroll processing, there are clear business advantages for daily pay. From worker retention to better productivity, the benefits of daily payroll impact both worker and employer alike.

1. Increased wage access

According to the 2021 FinHealth Spend Report, approximately 64% of Americans were ”financially vulnerable” in 2020. The report further states that low-to-moderate income households are up to seven times more likely to take quick cash loans. Daily payroll gives workers faster access to their wages instead of waiting for two weeks or more for paychecks. This ensures workers avoid late fees and expensive, predatory payday loans to cover everyday living expenses.

2. Increased worker productivity

Financial stress can lead to a lack of motivation and affect productivity. When employees are strained financially, it’s nearly impossible for them to concentrate on their job fully. Reducing that stress by providing a daily paycheck reduces distractions. With less financial strain, workers are more focused and bring their best efforts to work each day, leading to greater productivity.

3. Access to emergency funds

Emergencies and unexpected expenses can be devastating to workers. Tools like earned wage access apps have tried to solve for emergency expenses, but workers are only able to access a small portion of their funds and they’re charged fees or interest for doing so.

Daily payroll can gives workers access to wages they’ve already earned without strings attached. With daily payroll, workers have access to cash in the event of an emergency (e.g. a car repair) and don’t have to turn to drastic measures to cater to the difference. The cash reserve made possible with daily payroll prevents workers from going further into debt.

4. Better worker retention

The best workers are always in high demand. If you want to keep your top talent, you need to offer a combination of good pay and desired benefits. Businesses have a straightforward checklist for retaining workers like increasing compensation, offering bonuses, giving gifts, covering expenses, increasing health and dental benefits and expanding time-off policies. One of the major benefits of daily payroll is it costs a business much less than raising their hourly wage or enacting health coverage. For many workers, the ability to get paid daily is an impactful enough benefit that it keeps your talent from heading to the competition.

5. Reduces absenteeism

Another benefit of daily payroll is that it makes employees more aware of what their job means. Take gig workers, for example. Once a gig driver or delivery courier knows they won’t be getting a deposit on the days they fail to work, they’ll be more motivated to show up every day and get shifts.

Making lump-sum payments one or two weeks after a completed shift can cause a disconnect for workers. With daily payroll, workers see how much their hard work earns them in a day and motivated them in the future. This awareness, combined with the ability to access funds daily, reduces the rate of absenteeism on the job.

RELATED READING: 4 ways to motivate and incentivize gig workers

Why don’t most jobs pay daily?

Most companies don’t pay daily because they don’t have to. In the past, it was impractical and expensive for employers to manually pay workers every day. With current technology, there’s no reason why this should continue to be the case.

Daily pay is a popular benefit among gig companies and labor marketplaces, and is quickly becoming the norm for traditional businesses as well. However, some industries, especially those focused on paying independent contractors, have unique challenges. Verticals like construction, roofing, door-to-door sales and others face logistical challenges with daily payroll. But thanks to new contractor-focused payroll tools, these businesses are able to offer daily pay without running into cash flow issues.

Should companies pay people daily for their work?

The tight labor market has workers calling the shots. Merely not wanting to run daily payroll may not be an acceptable option for long, as worker demands grow and on-demand pay becomes more popular thanks to peer-to-peer apps like Venmo and Paypal. The benefits listed above like increased productivity and decreased absenteeism makes the case that paying people daily is good for business. As the rate of payments across all sectors (such as investing, e-commerce, and more) rises, the question of whether or not a firm should pay people daily may be replaced with how quickly can companies move to make paying people daily a normal part of their business operations.

Daily payroll solutions

The biggest obstacle for most companies is making the switch from bi-weekly or monthly payroll processing to daily payroll. The right payroll solution can make that switch much easier. Yes, the initial investment in a tool that offers daily payroll can be significant, but the long-term benefits for businesses and their workers are equally so.

With the right daily payroll solution, paying workers everyday doesn’t have to be tedious. Modern, automated payroll tools can make the switch from bi-weekly to daily payroll a seamless one for businesses. In some cases, your current payroll solution may offer daily payroll processing. If this isn’t the case, take this as a sign that it may be time to switch payroll providers.