The 2023 Gig Drivers Report is out now. Download it for free here.

The gig economy has been growing at an incredible rate over the past decade, with more and more people turning to gig work as their work of choice. In fact, 55 million-plus workers earn a living by performing flexible, on-demand jobs in the U.S.

Yet in an era of rising inflation and sky-high gas prices, one critical class of gig workers—rideshare and delivery drivers—face mounting and one-of-a-kind financial pressure.

For these reasons, it comes as no surprise that many businesses are struggling to hire and retain drivers. In fact, one report found that 50% of businesses are having a hard time finding drivers.

To get a better understanding of what gig drivers want and need today, Everee and the Restaurant Meal Delivery Association (RMDA) surveyed 315 gig drivers based in the United States who work in ridesharing or delivery. The full report reveals the state of gig driver satisfaction and how drivers are doing from a financial perspective. We’ve highlighted three statistics that will help gig and delivery industries tackle retention, growth and compliance challenges in 2023 and beyond.

Rising costs are hurting driver retention

According to our survey, the vast majority of gig workers are more satisfied with their jobs than they were a year ago. This is likely due to a confluence of factors, including less COVID-related fears as the world returns to normalcy, folks hitting their stride after having another year as a gig driver under their belts, and being able to earn more money when they want to—something that is particularly important in our era of unpredictable inflation.

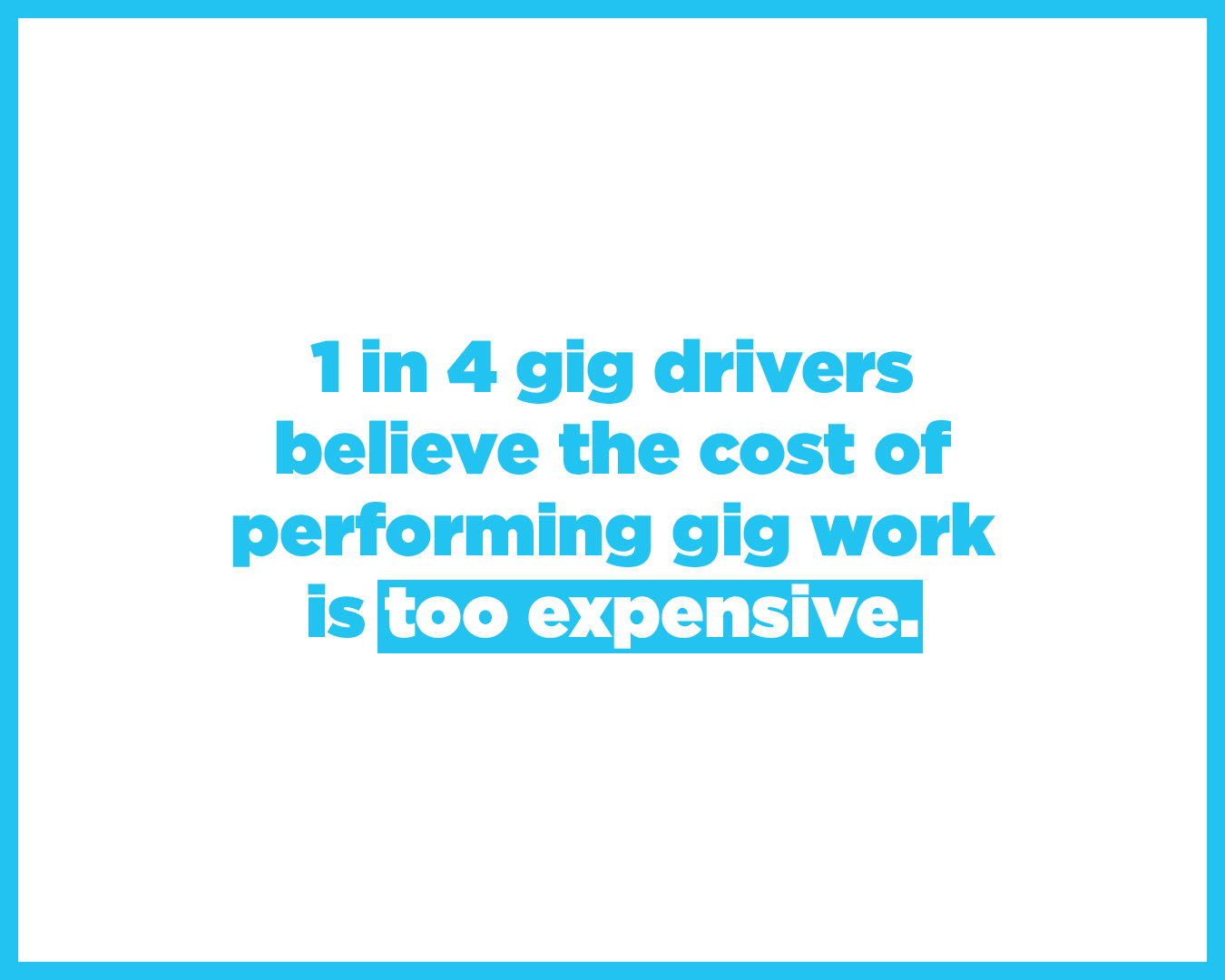

But higher satisfaction doesn’t necessarily mean drivers are going to stick around. While they’re happier now than a year ago, 1 in 4 (27%) of drivers say performing gig work today is too expensive and contributes to wanting to leave the industry within the next 12 months.

Gig drivers pick sides in the worker classification war

Despite years of headlines and legal battles, the worker classification war rages on—and gig leaders can’t afford to ignore the discourse. Whether their workers want to be independent contractors or not, gig leaders need to build in agility as federal and state laws change.

“Delivery companies need to assess now if the processes and tools they have in place for their 1099 workforces will support W-2 workers for onboarding, paying, and staying compliant,” says Andrew Simmons, president of the Restaurant Meal Delivery Association. “If not, they should act quickly, so that their workers are onboarded correctly, paid accurately and remain in compliance with applicable laws.”

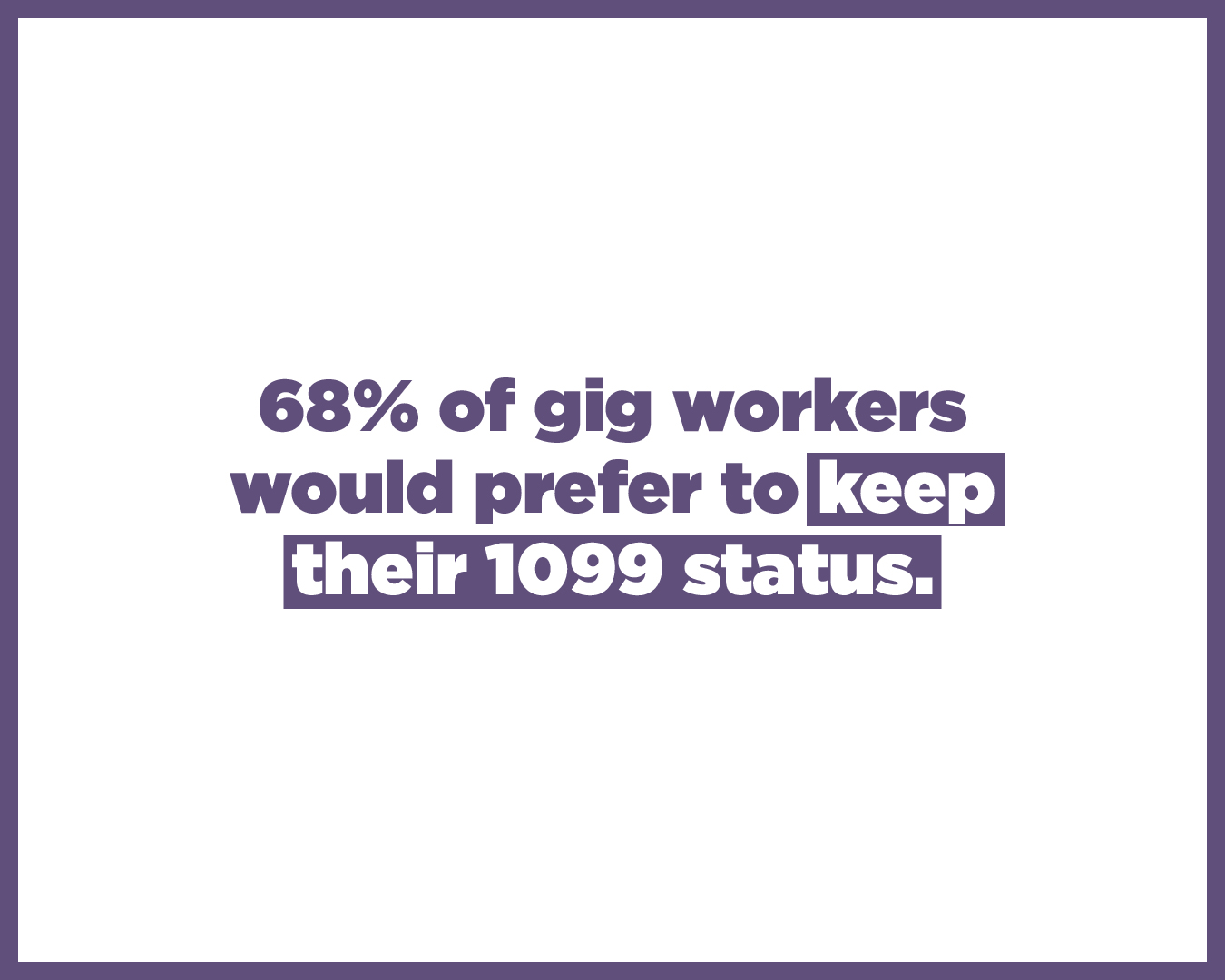

If given the choice between working as a 1099 contractor or a W2 employee, gig drivers by and large opt for the former in our survey. Sixty-eight percent would prefer to keep their 1099 status to maintain the flexibility that comes with being a part of the gig economy.

Speed matters more than ever before

The partner to flexibility is efficiency. And one of the key reasons companies might be struggling to find gig workers is due to the fact that they’re still relying on processes that move too slowly. For example, 42% of workers say they’ve declined a gig job because they had to wait too long to get paid. Similarly, 45% of workers say they’ve removed themselves from the running after experiencing a company’s onboarding process that stretched on too long.

With so gig drivers facing rising costs, gig companies should strongly consider implementing payment solutions that enable them to pay their workers instantly. By giving gig workers fast access to the cash they’ve earned, employers can help them improve cash flow problems while also proving they care about their financial well-being—a win-win scenario.

Leading HR and payroll automation solutions make the onboarding process lightning-fast and seamless from a worker’s perspective.

Tools like Everee makes it easy to pay 1099 workers instantly. To learn more about the easiest way to attract, hire, and engage gig drivers, request a demo of Everee today.

Don’t forget get your free download of The 2023 Gig Drivers Report here.