With nearly 51 million independent contractors working in the U.S. today, chances are your company or small business is paying a 1099 worker. And those payments—whether to a consultant, freelancer or gig worker—need to be reported to the Internal Revenue Service (IRS) using 1099 forms. This post will review the most common 1099 forms, worker classification and their corresponding forms, how to create a 1099 form, and the filing deadlines business owners need to know.

What is a 1099 form?

A 1099 form is a tax record of payments made to independent contractors and other non-employees. 1099 forms, like IRS Form 1099-NEC and 1099-MISC, are sent by employers to the IRS, as well as to the payees themselves.

1099 forms must account for all the earnings a non-employee has been paid in a calendar year. Because independent contractors are not classified as employees, 1099 forms don’t include any withholdings for Social Security or Medicare taxes.

Does an employer have to provide a 1099?

All employers, including small business owners, are required to submit a 1099-NEC or 1099-MISC form if payments to an independent contractor exceed more than $600 in the prior year. In most cases, payments made to recipients who are corporations, limited liability companies (LLCs) converted to S or C corporations or tax-exempt organizations don’t need to be reported via a 1099 form—these details are found on the worker’s W-9 Form.

RELATED READING: How to pay independent contractors

What 1099 form do employers use?

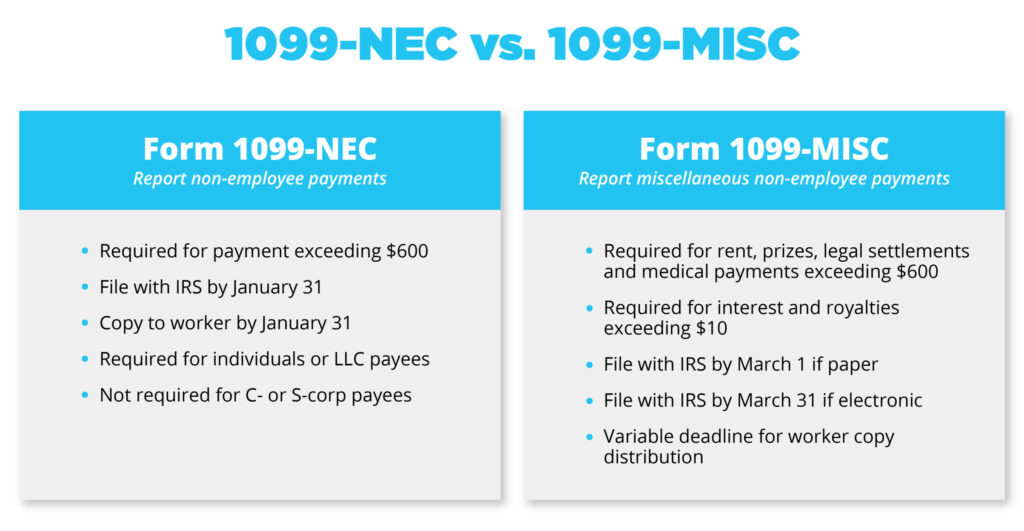

There are approximately 15 variations of 1099 forms, but the most common for employers to use are 1099-NEC (for non-employee compensation) and 1099-MISC (for miscellaneous payments to non-employees).

When to use Form 1099-NEC

Businesses should file a 1099-NEC if they have made payments of more than $600 to an independent contractor in exchange for business-related services like freelance work or consulting gigs. The 1099-NEC form was introduced in 2020 as the primary form for payers to report non-employee compensation, replacing the 1099-MISC form.

When to use Form 1099-MISC

Prior to 2020, the 1099-MISC form was the primary form for reporting payments to independent contractors. Today, a 1099-MISC is used to report miscellaneous payments to independent contractors made in connection with a business, like rent, prizes and awards.

What’s the difference between 1099-NEC and 1099-MISC?

A 1099-NEC is a form used to report an independent contractor’s income (non-employee compensation). A 1099-MISC is used to report miscellaneous income outside of services performed.

Even though the 1099-MISC is still around, employers should primarily use the 1099-NEC form for reporting payments to independent contractors in most cases.

Who needs a 1099 form?

1099 forms have two purposes: for payers to report the income of the service provider (the independent contractor) and to alert the IRS to taxable income. When an independent contractor files their tax return, they need an employer-provided 1099 form to account for the income they’ve earned.

What is the criteria for a 1099 employee?

Independent contractors are classified differently than W-2 employees, and their required tax forms are not the same. Employers should not file a 1099-NEC (or any 1099 form) for a worker classified as an employee. Instead, employers must submit a W-2 Form to report employee compensation like wages, tips and other employee income paid in the tax year.

RELATED READING: The differences between 1099 and W-2 workers

Independent contractor classification

An independent contractor is an individual or business that provides services to another company, usually on a contract basis. They’re usually hired to complete a specific project or task.

Employers should consider the IRS’s criteria for worker control and independence when classifying service providers as independent contractors:

- The worker is free from direction and control while performing services.

- The worker performs services that are outside the usual course of business for the company they’re contracted with.

- The contract between the two parties states that the worker is an independent contractor.

It’s important to also review state laws for worker classification. California’s AB5 law has strict requirements for classifying independent contractors (and a long list of exemptions) along with their own ABC test for independent contractor classification.

If you discover that the contractors is, in fact, working as an employee after evaluating these criteria, you should correctly classify them as such and make the needed adjustments for compensation and tax reporting. Failure to correctly classify a worker can result in hefty fines and penalties from the IRS.

1099 payments and labor marketplaces

If you use labor marketplaces like Upwork or Toptal to work with freelancers, you don’t need to file a 1099 form. But engagements via labor marketplaces are different from platform to platform, so confirm your tax filing responsibility before making a hire official.

RELATED READING: Gig worker classification explained

How to create a 1099

At the end of a tax year, it’s time to create your 1099 forms. First, you need the form itself. Note that you will need to create multiple copies for the IRS, your payee and your records. Here’s where to find the 1099 forms you need:

PDF 1099 form download: 1099 forms are available for download on the IRS website. The IRS offers fillable versions of the form that can be completed online. You can also find these on e-file providers’ websites.

Paper 1099 forms: You can order paper 1099 forms from the IRS by calling 800-TAX-FORM (800-282-3676). When filling out the paper form, make sure you get Form 1096 alongside your 1099 form, fill them out and mail them together. Form 1096 summarizes the 1099 forms you plan to issue and should be sent with copies of 1099. A Form 1096 is required only when mailing in your forms.

Payroll software: Most payroll software comes with functionality for printing and emailing forms.

Form 1099 tools: There are a handful of web-based software programs that offer transactional help with 1099 forms.

Accounting software: Common accounting tools like Quickbooks offer preparation of 1099 forms.

Hire an accountant: Apart from preparing your tax returns, tax professionals can also prepare and mail your 1099 forms.

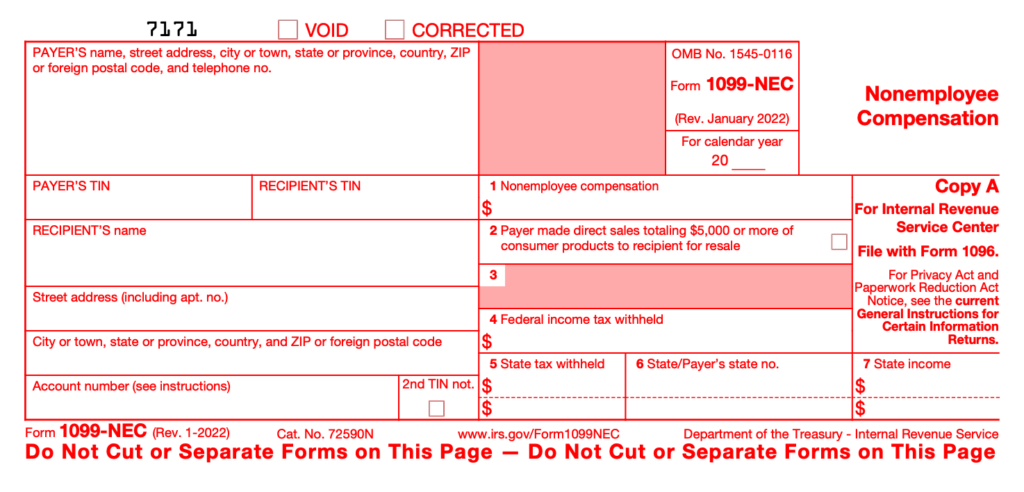

How to prepare Form 1099-NEC step by step

You must prepare a 1099-NEC form for each worker or vendor to whom you paid $600 or more in a tax year for services performed as a contractor. Here are the steps to follow to prepare a Form 1099-NEC.

1. Collect personal information from independent contractors with a W-9 Form

All independent contractors need to complete Form W-9. IRS Form W-9 has the required information you need to prepare Form 1099-NEC, like the worker’s legal name, address and taxpayer identification number (TIN). A worker’s TIN could be their Social Security number (SSN) or Employer Identification Number (EIN). For each worker you intend to file a Form-1099 NEC for, you need the required information found in Form W-9. If you don’t have one, reach out to the independent contractor and request one.

2. Confirm payment amount

Next, you’ll need to compile the total amount paid to the contractor during the tax year for services rendered. You may have tracked these payments manually or through payroll or accounting software. These records help compile an accurate report of all the payments made to each contractor. Finding the total amount paid will be easy if you’ve kept good records and documentation for all payments made. If not, you may need to go through your records and receipts to get an accurate number.

RELATED READING: Why you shouldn’t use apps like Venmo and PayPal to pay contractors

3. Complete the details submit Copy A to IRS

Once you have the Form W-9 and a report that confirms payment made to each contractor, you can prepare Form 1099-NEC. Complete the form for each vendor or contractor as required—this is known as Copy A. Review each form for accuracy, and file Copy A with the IRS electronically or through mail.

4. Provide Copy B to the independent contractor

Employers are required to provide a copy of Form 1099-NEC to the payee. This is known as Copy B, and it’s what the payee will use to file their taxes. Ideally, the copy is distributed digitally through email or a secure tax document portal. You must give your contractors a physical copy of their Form 1099-NEC if they don’t consent to receive digital copies.

4. Keep a copy for yourself

It’s best practice for employers to retain a copy of all 1099-NEC forms for their own records. The IRS may request these forms during an audit. Keeping a record for yourself is also helpful if a contractor’s copy is lost or destroyed and they make a request for another copy.

When are 1099 forms due?

The deadline for issuing Copy A of Form-NEC to the IRS and sending Copy B to payees is January 31st, regardless if you’re doing paper filing or electronic filing. Keep in mind that the January 31st deadline is a postmark deadline, which means as long as you have mailed the forms by this date, you’re considered on time.

The deadline for Form 1099-MISC is February 28th if paper filing or March 31st if e-filing. If this deadline falls on weekend, the due date is the next business day.

Review all instructions and deadlines for 1099 forms on the IRS website to ensure your business is compliant.

What are the penalties for not filing?

The IRS imposes a penalty for each information return that’s filed late, unless you can show reasonable cause. The IRS also imposes a penalty for each information return that’s not filed correctly, contains errors or is incomplete. If you don’t remedy the corrections needed, then you will face additional fines.

Payroll tools can handle 1099 filing for you

Payroll software can help employers handle manage and file 1099 forms. When choosing a payroll platform, look for a tool that offers features like the ability to track payments made to independent contractors, a repository for completed W- forms and the ability to generate and file end-of-year tax forms with the IRS. The best payroll tools ensure your compliance and offer pain-free payroll management for independent contractors.

Need a payroll system built for paying independent contractors? Let’s talk about how Everee can help.