The first thing you need to know about payday loans is that they are expensive. And popular. In 2020, the payday loan industry generated over 32 billion dollars and is expected to reach nearly 50 billion by 2030. This is due to the fact that workers want money in their hands now, and there are few well-known payday loan alternatives.

For many, a two-week pay cycle isn’t fast enough, but getting cash fast comes with a big burden for workers—one that often outweighs the initial ease payday loans offer.

What payday loans cost workers

Payday lenders don’t have stellar reputations. That’s because they charge high interest rates and fees, which are often difficult to understand, if not intentionally hidden from the borrower. While payday loan establishments advertise short-term lending, many workers end up indebted for months due to triple-digit interest rates and compounding fees.

Payday loan interest rates

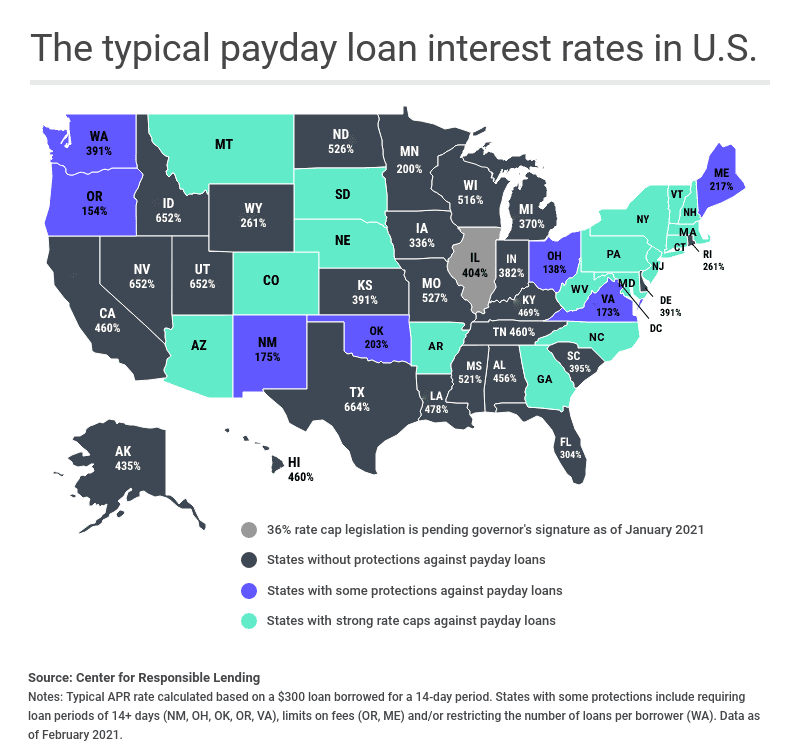

The allure of quick cash doesn’t come without steep rates for the majority of borrowers. Interest rates for payday loans swing wildly across storefronts and states. According to the Center for Responsible Lending, the APR for a 14-day, $300 cash loan can exceed over 600% in states like Texas, Nevada and Utah. These and many other states have no regulation capping interest rates set by payday lenders and represents about 200 million Americans—as seen in this image via CNBC.

Payday loan service fees

In addition to high interest rates, payday lenders also charge service fees that add up for workers who are already in a pinch. These fees can range from a few dollars to several hundred. In some cases, fees are applied again and again (as the lending period is extended) and often exceed the total amount a worker initially borrowed.

Predatory lending

Payday lending disproportionately impacts low-income populations. In 2013, payday borrowers had a median household income of $22,476—below that same year’s poverty guideline for a family of four in the United States.

In addition to the emotional stress associated with borrowing from payday lenders, workers often take on other debt and expenses such as credit cards, overdraft fees or late payment charges simply because they don’t have enough money to cover their remaining expenses after paying their lenders.

3 payday loan alternatives

Despite the costs, many workers still turn to short-term, high-interest loans to get cash fast when they’re stuck waiting for wages to hit their bank account. But what if there were better payday loan alternatives? What if workers could get paid sooner, even daily? New solutions exist that can replace payday loans and relieve the intense financial burden on all workers living paycheck-to-paycheck.

There are payday loan alternatives for cash-strapped workers who don’t want to enter into the often vicious cycle of high-interest lending (or who don’t have the time to visit a pawn shop for some extra funds). New, flexible pay options can help workers access their money on-demand and eliminate the need for payday loans.

1. Flexible payroll

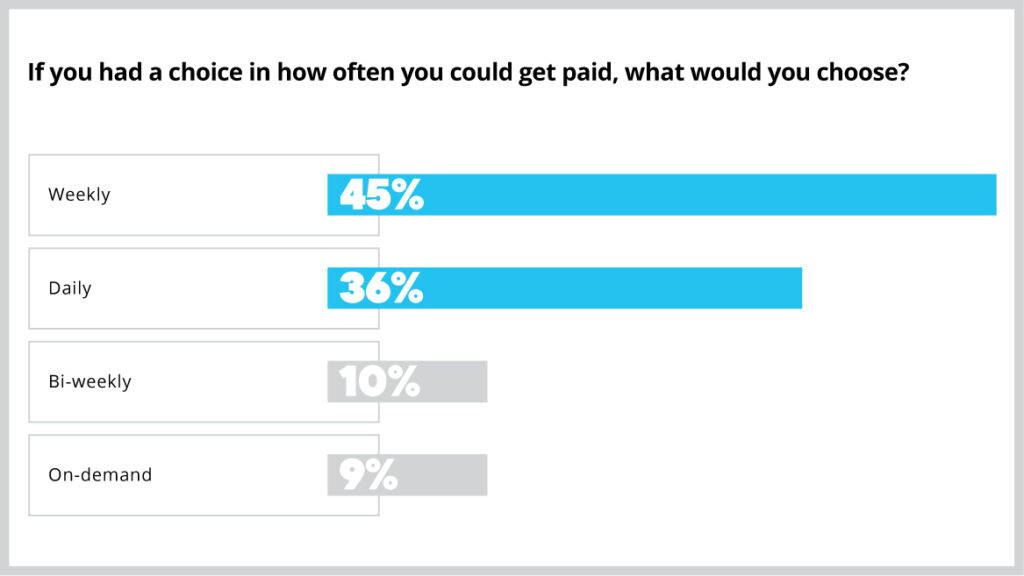

Flexible payroll means workers get paid faster and more often. With tools like Everee, employers can offer workers the ability to get paid weekly, daily or on-demand. If an employer is running paroll daily, workers can receive funds within 24 hours of completing a shift. If an employer isn’t running payroll on a daily schedule, workers can still request their weekly or on-demand. In the 2021 Gig Worker Survey Report, 90% of workers surveyed would choose a pay schedule other than the traditional bi-weekly cycle.

With flexible pay, workers get paid anytime they need it. This source of cash means that workers have an alternative to a payday loan when they need to cover a living expense. Flexible payroll is the preferred solution for workers who don’t want to be charged to access wages they’ve already earned and for employers who don’t want to manage advances for their workers. However, both of these safe payday loan alternatives are more cost effective and less predatory than a traditional payday loan.

2. Employer paycheck advances

Some employers may offer paycheck advances for workers who need to cover a temporary financial shortfall. This payday loan alternative is usually offered through the payroll system and requires no additional documentation or application process outside of usual human resources procedures, although some employers may ask for proof that the advance will be repaid with future paychecks. There is normally not a charge to the worker, though an employee may feel embarrassed to reveal their personal financial situation to their employer.

3. Earned wage access apps

In some ways, earned wage access (EWA) apps are merely a more digital-based version of a payday advance. The growing sector of EWA apps offers workers an alternative to payday loans where they get an advance on their paycheck, usually through a mobile platform. EWA apps all work roughly the same way: instead of waiting two weeks to get paid, workers are able to request access to small amounts of cash that they’ve already earned. The app usually charges workers a nominal fee to withdraw wages early. The remaining paycheck is deposited like normal on the regularly scheduled payday.

Flexible payroll is the best payday loan alternative

Flexible payroll tools are the answer to the payday loan problem plaguing workers today. When workers are able to get paid when they want to, they don’t have to turn to payday storefronts for instant cash. In addition to helping workers get paid fast, flexible payroll is an alternative to payday loans that doesn’t cost the worker more money they don’t have.

For employers, the cost of a switching payroll providers to a flexible solution is not any more than a typical payroll platform, and, in some cases, may even cost less. Additionally, when payroll can be run outside of the two week pay cycle, employers will also find their workers don’t need to ask for paycheck advances.

Flexible payroll means workers get money fast

In many cases, workers are just trying to get small amounts of money fast to cover emergencies or necessary expenses. Research shows that 7 out of 10 borrowers turn to payday loans to cover recurring expenses like rent or food.

Getting paid daily through tools like Everee reduces the two week wait for wages, eliminating the need to turn to payday lending in order to have cash in hand. When workers have a portion of the pay they’ve earned everyday, high interest loans and credit cards lose their utility, but bills that are due and other time-sensitive expenses get covered.

Flexible payroll costs less than payday loans

In fact, in most cases, it costs workers absolutely nothing. Most flexible pay platforms give workers financial security without any fees at all, as employers purchase payroll tools as part of their necessary business operations. This is ideal for workers who are already facing financial uncertainty.

If you’re an employer, what does paying for a flexible payroll platform look like? For a tool like Everee, a business would pay $10 per employee, per month after paying a one-time setup fee. Of course, for many industries, it’s difficult to pay workers before the business has collected its needed payments. Many companies take advantage of Everee Credit, which funds faster pay to workers, so businesses don’t have any cash flow issues.

Regulation continues to fight payday lending

Despite its meteoric rise over the past 50 years, payday lenders are facing increasing regulation at the state and federal level. In June 2021, Hawaii became the latest state to cap payday loan interest rates at 36%—a far cry from the ~400% rate payday lenders enjoyed before.

Other states are exploring regulation for payday lending that will make it more difficult for payday lenders to operate, such as capping the number of loans a person can take out in a certain period of time.

At the federal level, the Consumer Financial Protection Bureau (CFPB) has made its intentions known over the past year that it would seek to regulate payday lenders as larger financial entities.

In a March 2021 blog post, CFPB’s then acting director stated: “The CFPB is acutely aware of consumer harms in the small dollar lending market, and is particularly concerned with any lender’s business model that is dependent on consumers’ inability to repay their loans…to the extent small dollar lenders’ business models continue to rely on consumers’ inability to repay, those practices cause harm that must be addressed by the CFPB.”

This means that the traditional form of payday borrowing may no longer be as viable or as popular an option for workers who need small amounts of money quickly. As regulation sweeps through payday lending, the demand for payday loan alternatives will grow, and flexible payday tools will meet the needs of workers in a bind.

Employers have a role in ending payday lending

For too long, payday lenders have been a necessary evil driven by the urgent need to get paid faster than every two weeks. The industry has thrived on exploited communities and unscrupulous tactics that harm workers and, in turn, the economy.

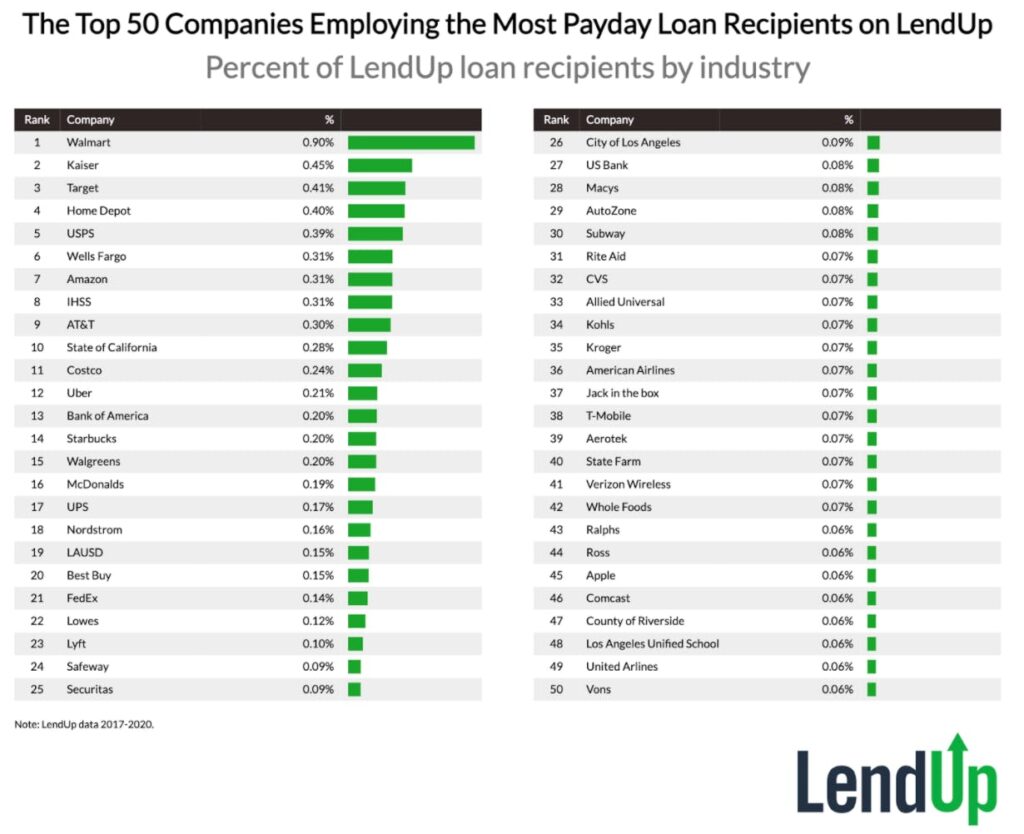

Employers have a responsibility to offer payday loan alternatives and stop the cycle of payday debt. This is especially needed in the retail, healthcare, food service and delivery industries. According to a study of LendUp customers who turned to payday loans between 2017 and 2020, twice as many loan recipients worked at Walmart compared with the second most common company Kaiser.

With new technology and a changing regulatory landscape, payday lending is no longer the only option for workers to access cash quickly. As tighter regulation threatens lenders, worker demand will grow for flexible payroll tools that offer fast access to pay, and this is where employers can answer the call.

Business leaders can offer alternatives to payday loans through flexible payroll tools, so workers can access their wages daily. Employers may play a significant role in ending an unethical industry that preys on workers by investing in new technologies that are able to process payroll daily, instead of every two weeks. And because financial stress negatively impacts productivity and worker retention, fast pay options help improve worker morale and tenure. A future without payday loans is good business for employers and workers alike.

Want an easy way to pay your workers every day? Check out Everee.